Why late payment interest should include GST

MCST that exceeds SGD one million in revenue in a calendar year, will be required to charge GST.

SP that pay their MF and SF with GST later than the grace period will have to pay late payment interest.

The question now is…Do you include the GST portion to arrive at the late payment interest income?

Some, if not many managing agent claims that the GST portion should not be included in the calculation of the late payment interest amount.

Only the MF and SF portion is chargeable for the late payment interest.

If you are using a legacy software that was in use before 1994 where GST was implemented, chances is that the software do not have the line item for GST to be included in the late payment charges calculation. Or even if there were upgrade, it is for convenience rather than necessity to include GST in the late payment charges calculation.

So the by-law never specifically state that the late payment interest should or should not include GST and by default, not including the GST portion, for calculation purpose. It is like the No U-Turn syndrome that late Sim Hwan Hoo mentioned.

We are in the opinion that the full amount, including the GST should be included in the late payment charges, if SP paid after the grace period.The reasons as below.

- GST department charge late interest if the payment is late. On a back-to-back basis, it is only right that late payment be calculated inclusive of the GST portion

- Some SP paid MF and SF without the GST, knowing that GST do not attract late payment interest, delay to pay that portion.

This is unfair that the rest of the SP paid the GST portion in full to the GST department on their behalf, when the monies should be for better use.

Of course the amount and number of SP is usually small in comparison, but the spirit of fairness and equitable comes into question. - Partial payment makes the matter more complex where system have to regross the amount to offset the full invoice and any unpaid balance has to regross to arrive at the MF and SF portion. This makes the system to work extra hard to arrive at the accurate last cents of the late payment interest.

We recommend that the next AGM, set this topic as an agenda to allow MA to charge late payment interest including the GST portion that remains unpaid.

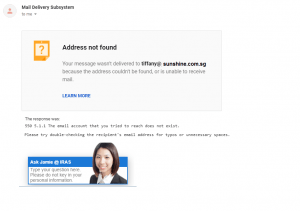

Contact us for more information via our sales whatsApp +65 8148 8824 for more information.

Writer : Choo Hong Peng,

Writer : Choo Hong Peng,

Chartered Accountant, Singapore

Email : sales@realtimme.net

01/08/2023